Negative Credit Scores Lendings - What You Must Know Prior To Looking For One

Content writer-Frost MasseyThere are several lenders providing negative credit rating fundings online. These lenders are efficiently financial institutions without a brick-and-mortar presence. They can make decisions on your application in minutes and also down payment funds in a matter of hrs or days. They typically don't charge application costs or pre-payment penalties. Candidates that have bad credit score may not have the ability to obtain a standard finance due to their poor credit rating. Nonetheless, negative credit scores lendings offered by these loan providers are a practical alternative.

There are a number of aspects you have to take into consideration prior to requesting a negative credit rating loan. First off, you have to make certain that you can afford to pay back the financing. When comparing various lending institutions and lending amounts, make sure that the repayment routine you are used is sensible. Likewise, you need to ask if you can pay for the regular monthly repayments. If not, simply click the following internet page need to avoid getting a poor debt funding completely. As soon as you have actually chosen a lending institution, be sure to read the lending conditions extensively.

Always ensure the lending institution you are thinking about has a good credibility. Do not rely on those who contact you without prior approval. The reason is straightforward: they're trying to find your individual information. Legitimate loan providers will not call you or message you to solicit your personal information. If a loan provider is reputable, they won't ask you to pay any type of in advance charges or fees. If a loan provider requests money beforehand, do not trust their internet site.

In many cases, poor credit finances are a temporary monetary solution for a consumer with poor credit rating. They often have a high interest rate. Nonetheless, they can be an exceptional beginning point for a monetary turn-around. If utilized appropriately, these fundings can be a vital device in rebuilding your credit rating and ending up being a much more attractive borrowing possibility. This type of finance is a beneficial device for attending to emergency situation situations and settling debts.

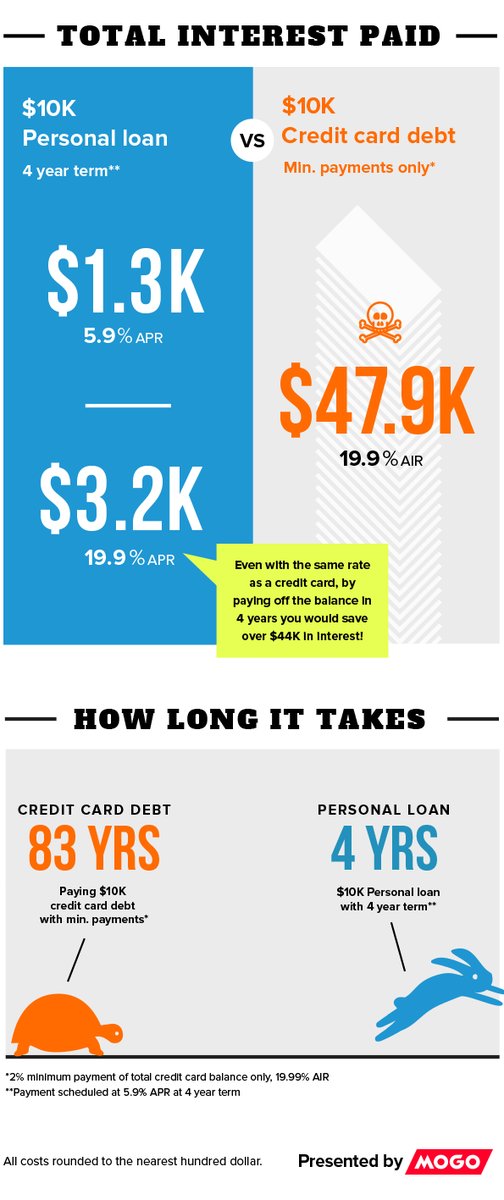

You can select an amount to borrow from a series of different lenders. BadCreditLoans require a credit history of 500 or above. Smaller car loans with a reduced credit history are offered. Other elements that identify the total price of a negative debt finance are your earnings, the rate of interest, settlement terms, and also the annual percentage rate (APR). Typically talking, negative debt financings have higher APRs than their standard counterparts.

Prior to you make an application for an individual lending for negative credit score, make sure to investigate your alternatives carefully. Study the different types of financings supplied on-line by respectable economic organizations. Visit their internet sites and evaluate their product details. You can likewise utilize Google to find out which lending institutions supply poor debt finances in your state. Then, compare the various alternatives and also pick the one that fits your needs best. Keep in mind, bad debt car loans exist to help you out, however you need to do your due persistance to find the very best option.

The chances of obtaining approved for a funding are straight related to your credit score. A lower rating suggests a higher threat, and thus a lower opportunity of approval. The rate of interest is additionally affected by your credit history. Consequently, it is very important to preserve a high score as long as possible. linked here are similar to traditional installation finances, such as car financings and repaired rate home loans. There are numerous reasons negative credit scores financings may be readily available to you.

If you're looking for an individual car loan for bad credit report, you can make use of the on the internet industry PersonalLoans. This website supplies personal finances from a big network of trustworthy on-line loan providers. The business's track record is based on its substantial network of lenders and also third-party lender. The firm's rates and also repayment terms are affordable and also they have low charges. In addition to these, PersonalLoans has a number of other benefits for negative credit rating consumers.

A personal line of credit resembles a charge card, with the major difference being that you just pay rate of interest on the amount you in fact make use of and spend. This is a benefit compared to other individual fundings, which are commonly provided as a lump sum. Nevertheless, personal lines of credit allow consumers to pick the amount they wish to borrow, and request a lot more funds as their equilibrium is settled. Oftentimes, a family member will offer you a personal car loan that has adaptable terms and also charges.